|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Comprehensive Guide to Home Loan Assistance ProgramsSecuring a home loan can be a daunting task, but with the right assistance, you can make the process smoother and more accessible. Home loan assistance programs are designed to help potential homeowners navigate the complexities of securing a mortgage. In this guide, we'll explore various aspects of these programs and how they can benefit you. Understanding Home Loan Assistance ProgramsHome loan assistance programs are initiatives that provide financial support and guidance to individuals seeking to buy a home. These programs can be especially beneficial for first-time buyers or those facing financial constraints. Types of Assistance Available

These options can be explored by those looking to take advantage of programs such as first time home buyer ma, offering tailored benefits for new homeowners. Eligibility CriteriaEligibility for home loan assistance programs often varies by location and program specifics. Generally, applicants must meet certain income requirements, demonstrate financial need, and sometimes participate in homebuyer education courses. Common Eligibility Requirements

These criteria ensure that applicants are ready for the responsibilities of homeownership. How to ApplyApplying for a home loan assistance program typically involves several steps, including gathering documentation, meeting with a lender, and possibly attending workshops or courses. It's essential to understand the specific application process of the program you're interested in. Steps to Apply

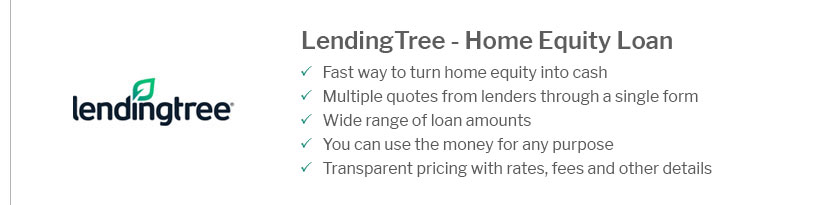

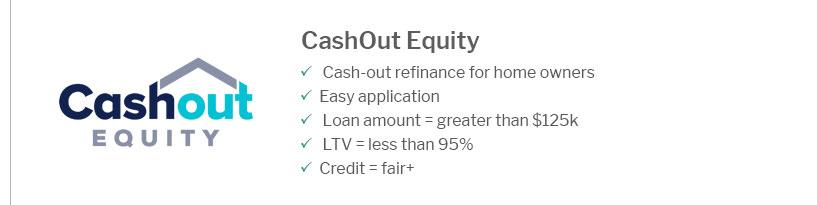

Some programs, like refinance 95 loan to value, offer refinancing options that can be advantageous for those looking to adjust their current mortgage terms. FAQWhat is a home loan assistance program?A home loan assistance program is a financial aid initiative designed to help individuals purchase a home by providing support such as down payment assistance, interest rate reductions, and loan forgiveness. Who qualifies for home loan assistance?Qualification varies by program, but generally includes criteria like income limits, creditworthiness, and completion of a homebuyer education course. How can I apply for a home loan assistance program?To apply, research available programs, gather necessary financial documents, and consult with a lender to explore your options. By understanding and utilizing home loan assistance programs, you can make the dream of homeownership a reality, even if you face financial challenges. With careful planning and guidance, securing a home loan can be an achievable goal. https://www.michigan.gov/mshda/pathway-to-housing/firstgendpa

Becoming a homeowner isn't easy, especially if no one in your family has owned a home before. That's why ... https://www.michigan.gov/mshda/pathway-to-housing/mi-home-loan

The MI Home Loan program is a mortgage product that is available to first-time homebuyers state-wide and repeat homebuyers in targeted areas. https://www.usa.gov/buying-home-programs

If you have a low income and want to buy your first home, the Housing Choice Voucher homeownership program could help. It may also help you pay monthly housing ...

|

|---|